Brad Bernstein, a financial analyst writing for Coindesk, has posted an interesting blog on crypto valuations. He writes:

The key to ascertaining fundamental value in crypto is an understanding of [1] economic activity – transactional usage of the token + the store of value component and [2] velocity – how frequently the token changes hands.

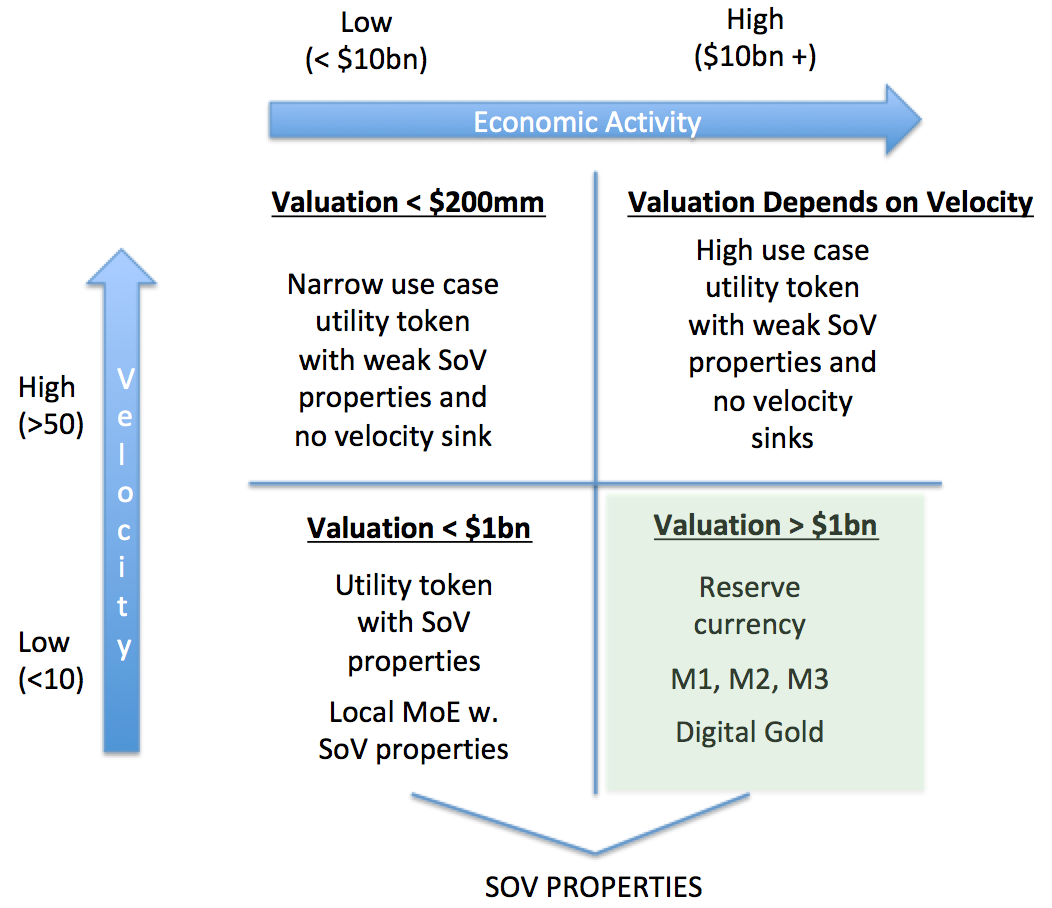

The matrix below helps me think about value accrual along these two dimensions using the quantity theory of money – the best framework to reason about currency and token valuation today:

This matrix paints the picture that the only way an asset can ultimately be worth more than $1 billion is if it is in the bottom right quadrant: High economic activity and low velocity. ($10 billion divided by 10 = $1 billion market cap)

The problem, Bernstein argues, is that velocity itself is a product of high levels of risk. As a result, he concludes that the only assets individuals will be comfortable holding a substantial amount of wealth in are those that function as stores of value. He writes:

If you’re investing in an asset today with a valuation in the hundreds of millions, to generate a positive risk-adjusted return you need those millions to turn into billions. Because only reserve stores of value will be worth billions, you’re implicitly betting that the asset becomes one.